Explain Different Types of Capital Structure Theories

Capital structure is the proportion of all types of capital viz. The formula of capital structure quantifies the amount of equity and the amount of outsiders capital at a point in time.

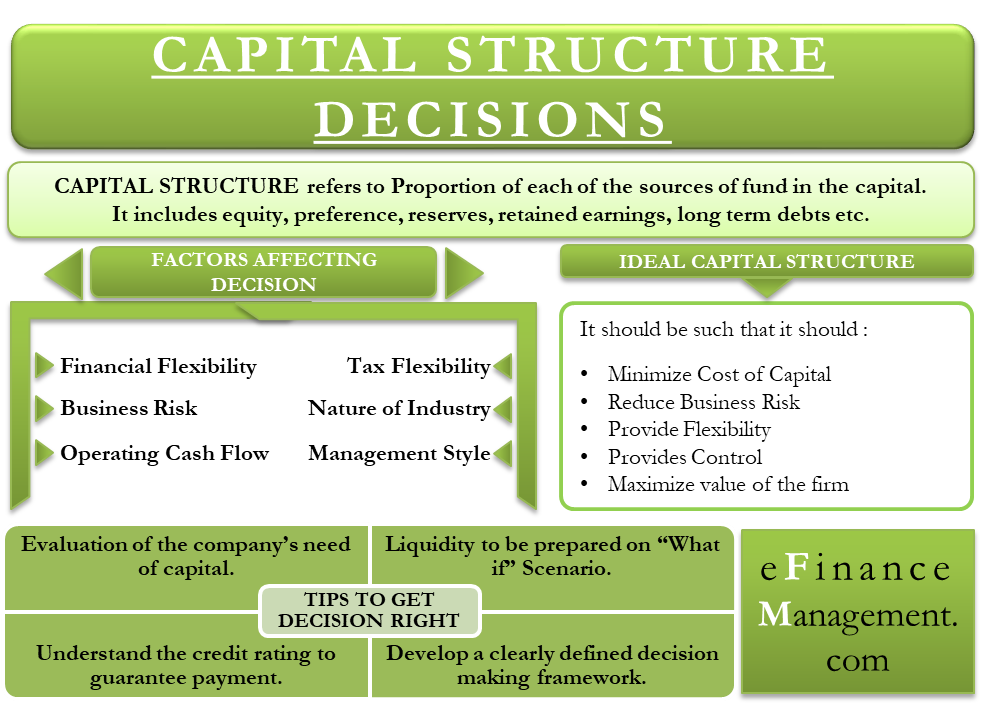

Capital Structure Decisions Importance Factors Tips And More

When cost of capital is lowest and the value of the firm is greatest we call it the optimum capital structure for the firm and at this point the.

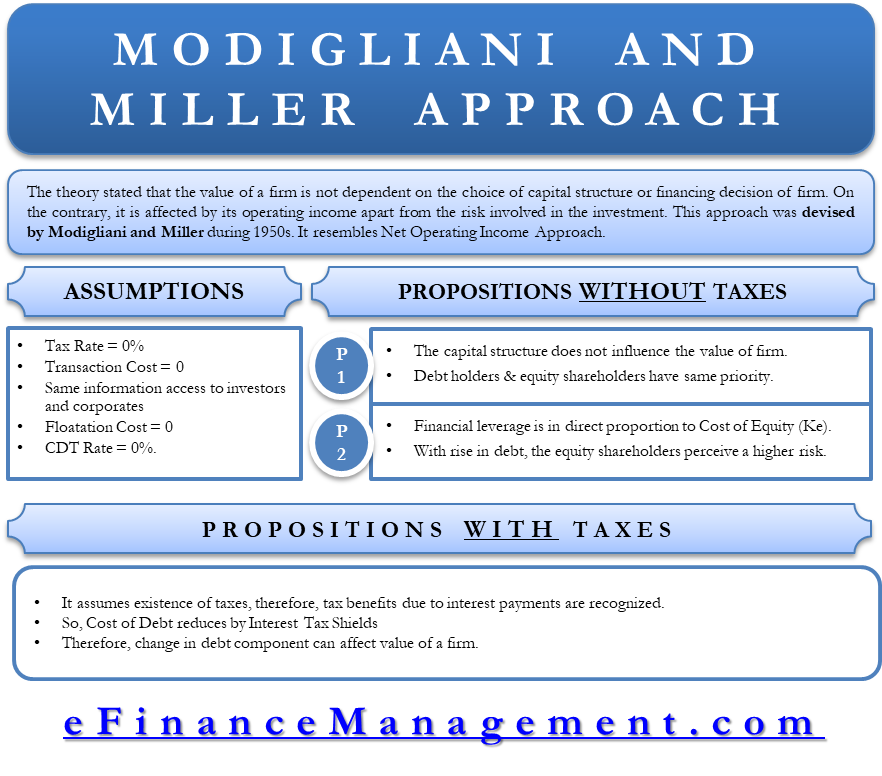

. According to him a. Ameliorate conflicts of interest among various groups with claims to the firms resources including managers the agency approach. The Modigliani-Miller Theory The Modigliani-Miller theory is used in financial and economic studies to.

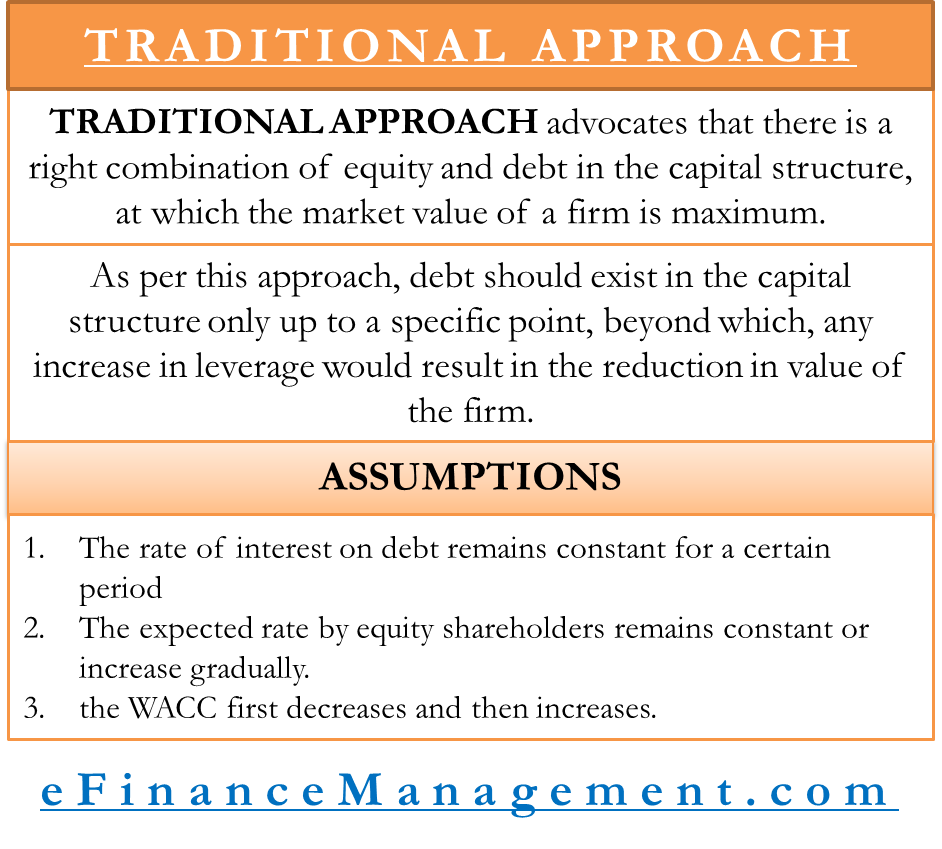

Capital Structure Theory Traditional Approach. According to NI approach a firm may increase the total value of the firm by lowering its cost of capital. Net Operating Income Approach.

According to this approach a firm can minimise the weighted average cost of capital and. Net Operating Income Approach. Trade-off theory agency theory and pecking order theory has been analyzed to develop hypothesis related to determinants of capital structure of automobile sector.

Durand suggested this approach and he favored the financial leverage decision. This theory as suggested by Durand is another extreme of the effects of leverage on. ThEoriEs of Capital struCturE Net Income NI Theory Net Operating Income NOI Theory Traditional Theory Modigliani-Miller M-M Theory 10.

Net Operating Income Approach. There are different forms. A Cost Theory of Capitalisation and.

Equity debt preference etc. Theories of Capital Structure explained with examples Financial Management. Capital structure is the mix of sources of capital used in financing business operations.

Two theories have been propounded and used in this respect. The existence of an optimum capital structure is not accepted by all. A company with a higher debt-equity ratio is a.

Equity capital is the money owned by the shareholders or owners. The four important theories of capital structure are. These are the desire to.

There exist two extreme views and a middle position. Capital Structure and its Theories Capital Structure. There are two types of capital structure according to the nature and type of the firm viz a Simple and b Complex.

The traditional approach to capital structure suggests an optimal debt to equity ratio where the overall cost of capital is the minimum and the firms market value is the maximum. The Theory of Capital Structure 299 tion of the relationships among similar models. When the capital structure is composed of Equity Capital only or with Retained earnings the same is known as Simple Capital Structure.

Out of these theories Net Income approach and. Let us calculate capital structure using the DebtEquity formula. We can do such calculations as a percentage of each money to the total capital or debt to equity ratio.

According to James van Horne Capital Structure refers to the Mix of a firms permanent long-term financing represented by debt preferred stock and common stock equity. Once the concept of capitalization is explained and made clear a natural question arises as how to ascertain the required capital for a newly-promoted concern this is called the amount of Capitalisation. According to this approach a firm can minimize the weighted average cost of capital and.

Optimal capital structure is. Net Income NI Approach. Types of Capital Structure Equity Capital.

Theories of Capital Structure Net Income Net Operating Income Traditional Modigliani and Miller Approach With Calculations 1. Statement of Financial Accounting Standards No. Statement of Financial Accounting Standards No.

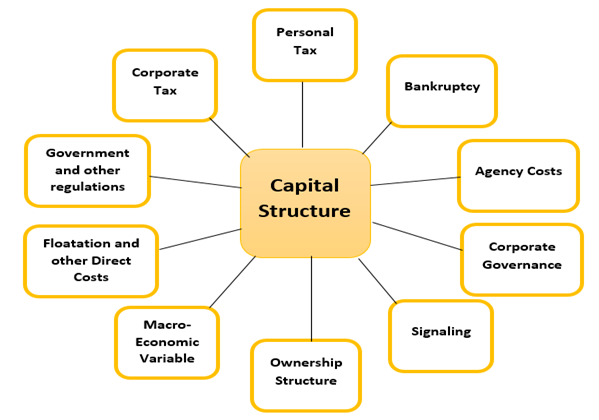

Bankruptcy costs which include legal fees can erode a companys overall capital structure. Understand the definition of capital structure and. On the basis of review determinants pecking-order theory are Liquidity and Firm size having and Profitability and Asset tangibility having positive effect on the debt-to-capitalratio Market timing theory The market timing theory of capital structure argues that firms time their equity issues in the sense that they issue new stock when the stock price is perceived to be overvalued and.

It can simply be defined as the. The following points will highlight the top four theories of capital structure. On either side of this point changes in the financing mix can bring positive change to the firms value.

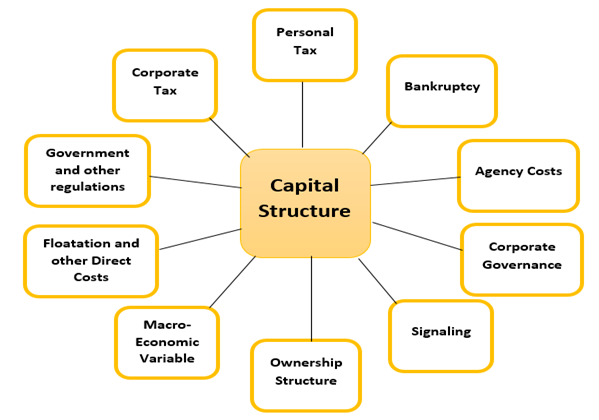

The Important Theories of Capital Structure are given below. Since that time several theories have been developed to explain the capital structure of a firm including the Pecking Order Theory Trade off theory and the Agency Cost theory. We have identified four categories of determinants of capital structure.

Modigliani and Miller Approach. This paper will shed light on the concept of capital structure its theories and link with firms performance. This theory as suggested by Durand is.

Debt capital is referred to as the borrowed money that is utilised in business. Static Theory of Capital Structure It is a theory according to which the capital structure of a company can be found out by a trade off of the tax shields value against the bankruptcy costs. The composition of various long-term sources of finance such as equity capital preference capital and debt capital make up the capital structure of a business.

Random Finance Terms for the Letter S. Capital Structure Theory 1.

Capital Structure Theory Traditional Approach Efinancemanagement

Capital Structure Theory Modigliani And Miller Mm Approach Efm

Design Of Capital Structure Designing Of Capital Structure Theories And Practices

Comments

Post a Comment